Itaú BBA recently released a comprehensive report analyzing the main challenges and opportunities facing Brazilian agribusiness, the Agro Monthly Report 07/2024. Among the topics covered were crucial issues such as innovation, sustainability and the market dynamics that directly affect the sector.

In this article, we present the main points of this study, offering a clear and practical view of how these factors impact agribusiness and how professionals and investors can prepare for changes in the agricultural scenario.

Livestock

Cattle

Brazil can now export bone-in beef to Egypt, following authorization from the governments of both countries. This opening represents Brazil’s 91st market conquest in 2024, strengthening the presence of Brazilian agricultural products abroad.

In 2023, Brazil exported around US$1.73 billion in agricultural products to Egypt, with animal proteins accounting for US$384 million of that figure. Between January and June, Brazilian exports to Egypt totaled US$1.31 billion.

In addition to beef, the Egyptian market had already allowed goat and sheep meat and offal into the country in March. With more than 110 million inhabitants, Egypt is one of the largest importers of beef in the world, and this opening promises to significantly increase Brazilian exports to the country.

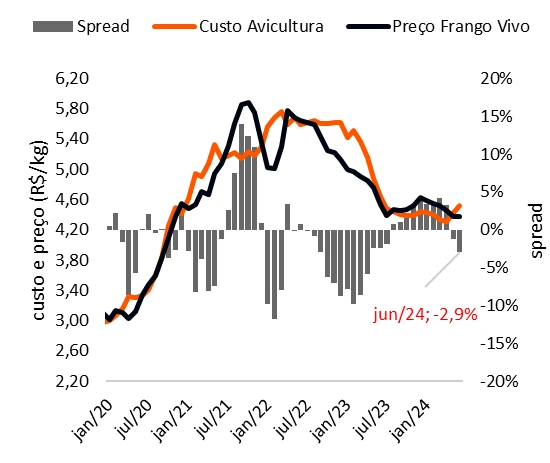

Birds

Poultry costs have risen, and without an equivalent rise in poultry prices, the activity’s spread has become negative, although the first half of the year ended on a positive note. At the São Paulo wholesale market, chicken meat prices remained stable at R$7.10/kg, without the intense fluctuations seen in previous years. This stability, 18% higher than in June 2023, reflects a balanced pace of production, which has prevented a devaluation similar to the one that occurred in the second quarter of last year.

Pigs

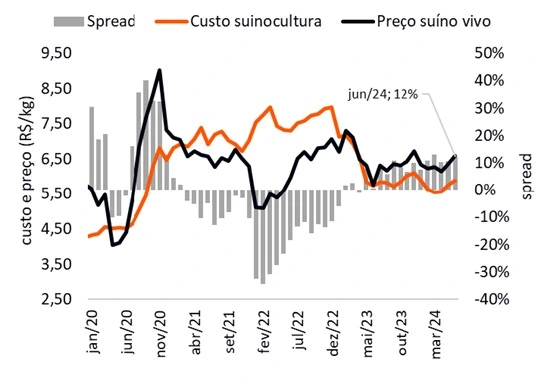

Pig farming has shown resilience, with pig prices keeping pace with rising costs, but maintaining high spreads that guarantee the profitability of the activity.

Despite an estimated 2.3% increase in production costs, the price of live animals rose by 3.8%, resulting in a spread of 12%, equivalent to R$86 per head.

In addition, the sector continues to excel in exports, with the animal 14.5% more valued compared to June 2023, while costs have risen by 3%.

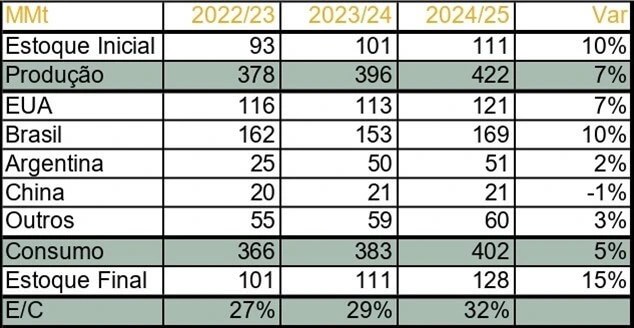

Grains and oilseeds

Soy

In June, soybean prices in Chicago fell by 3.7%, averaging USD 11.73/bu, pressured by good planting progress in the US and an increase in short positions by funds.

However, in Brazil, prices in Paranaguá recorded their fourth consecutive monthly rise, with the sack appreciating 2.4% to R$138.95.

This increase was driven by positive premiums and the depreciation of the real, benefiting Brazilian producers.

Corn

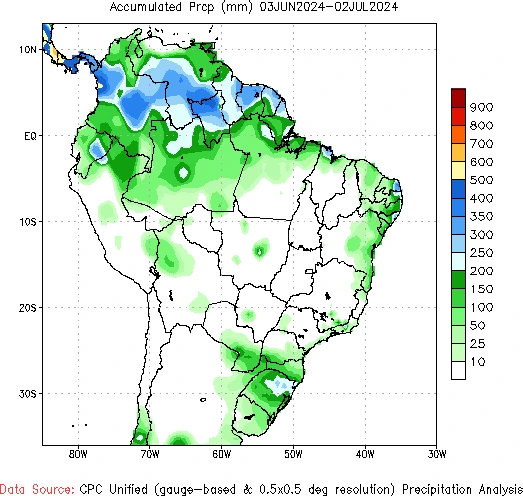

The US quarterly report brought surprising figures for corn, with stocks of 126.8 million tons (MM t) in the second quarter of 2024, exceeding expectations of 123.8 MM t and well above last year’s 104.2 MM t.

The planted area also surprised, projected at 37 million hectares (MM ha), up from the 36.6 MM ha expected and the 36.4 MM ha in the previous report. With production estimated at 383.4 million tons for the 2024/25 harvest, there is a positive difference of 5.9 million tons compared to the June WASDE report.

This increase could put pressure on prices in Chicago, especially if the weather in July and August, which are expected to be hotter than average, has an impact on productivity.

Wheat

The global wheat market in June was marked by strong volatility, driven by adverse weather conditions in the Black Sea region and in Europe, which faced droughts, frosts and excess moisture. These storms led to speculation about the impact on supply in a region responsible for around 45% of global exports.

In Chicago, wheat prices fluctuated sharply due to successive frosts and droughts in the Black Sea and excess moisture in French crops, which is likely to affect global supplies.

However, improved conditions for wheat harvested in the American plains put downward pressure on prices, with a bushel of wheat quoted at USD 5.54, down 17.4% on the start of the month, limiting the rises driven by corn.

Rice

Rice prices fell in June due to the slow resumption of logistics in Rio Grande do Sul, after the government adopted palliative measures such as exempting imports to increase local supply via CONAB.

According to CEPEA, the indicator for paddy rice in Rio Grande do Sul closed the first Thursday of the month at R$114/sc, down 3.4% in a month.

Demand remains sluggish, with buyers waiting for further falls and using up previously acquired stocks. Even with lower liquidity, the industry has managed to maintain margins and pass on costs to wholesalers.

In São Paulo, the main consumer state, the average sold in June was R$172/bunch (30 kg), 4.4% above the May average, guaranteeing the industry’s operating margin.

Agro-energy and by-products

Ethanol

The price of hydrous ethanol in São Paulo has continued to rise since the beginning of the year, driven by high demand due to the biofuel’s favorable parity with gasoline. In Paulínia, the price closed June at almost R$2.60/l, excluding taxes, an increase of 6.7% in the month.

This rise is atypical for the period, as sugar and ethanol mills usually face a cash crunch due to high costs at the start of the harvest, which would normally lead to high supply and downward pressure on prices.

Oil Bran

Oil meal, a vital by-product of vegetable oil extraction, plays a crucial role in animal nutrition, especially in poultry and pig feed. In 2024, soybean meal production in Brazil is expected to reach 34.6 million tons, an increase of 2.8% over the previous year.

Domestic demand, coupled with exports totaling 17.4 million tons in 2023, has kept prices high, especially in Asian markets.

The average price of soybean meal FOB Paranaguá, for example, closed June at USD 480 per ton, reflecting an increase of 5.2% compared to the previous month, driven by the appreciation of the dollar and the rise in production costs.

Sugar

The price of the NY No. 11 sugar contract for June 2024 expired above 20 cUSD/lb, after hitting the year’s lows in May. The rise was driven by negative production surprises for the next Indian harvest and the lower sugar mix at the start of the harvest in Brazil’s Center-South (CS).

Concerns about the Indian harvest and a sugar mix of only 48.5% at the start of the harvest in Brazil’s Center-South (CS) were the main factors behind the rise. Despite this, the devaluation of the real against the dollar prevented more significant increases in international prices.

The market continues to pay close attention to the Brazilian harvest, which started off in line with last year, but is facing productivity challenges due to the dry weather. Estimates indicate a drop of more than 10% in agricultural productivity compared to the previous year, reflecting a lower than expected sugar production: 2.26 million tons in the first half of June, against projections of 2.5 million tons.

The low quality of the raw material and recent investments in production capacity that have not yet had the expected effect intensify the uncertainties.

Fruit growing

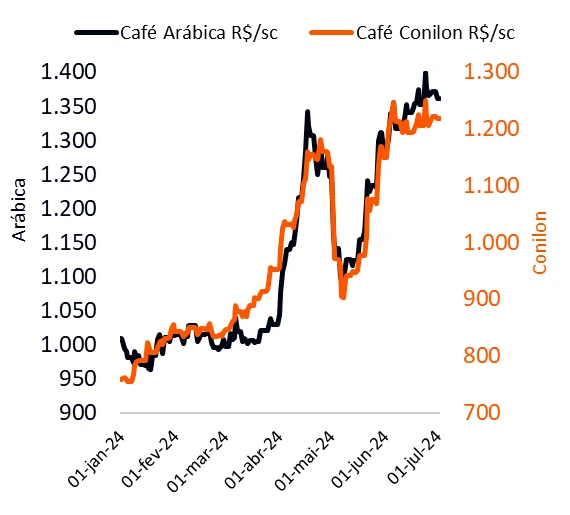

Coffee

The USDA released its estimate for the 2024/25 global coffee balance, projecting Brazilian production at 69.9 million bags, slightly up from the 69.4 million previously forecast.

Arabica should reach 48.2 million bags, up 7.3% on last year, while robusta should reach 21.7 million bags, up 1.4%.

Despite this optimistic forecast, the market remains attentive to factors such as the risk of frost in Brazil and the low availability of coffee from the new harvest, which should keep prices high in the short term.

Orange

The tight supply of oranges for the 2024/25 Brazilian harvest and the growing competition for the fruit boosted prices in June. Despite this, the crushing industry’s spread on juice sales remains high, with the NY market quite stretched.

In the last two months, the price of a box of oranges sold to the industry has risen from R$60 to R$80, an increase of 33%. The low availability of fruit continues to drive competition between buyers, favoring producers who obtain up to 45% of net revenue in dollars from the operation.

Fibers and Agricultural Inputs

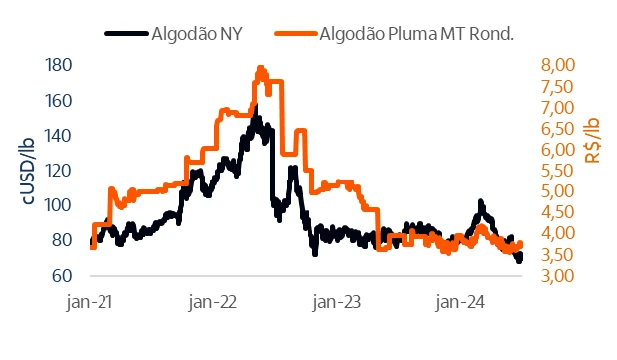

Cotton

Brazilian cotton exports remain below the historical average, despite a new low for the real against the dollar and record production in the US.

The premium for good quality Brazilian cotton fell by more than 2 cUSD/lb, further pressured by reduced demand from the Chinese market, where stocks are high. As a result, the Mato Grosso parity fell to 80 cUSD/lb and the CEPEA/ESALQ average in Brazil stood at 82 cUSD/lb, the lowest level since 2021.

At the same time, Mato Grosso’s cotton indicator fell by more than 5% last month, reflecting the challenges faced by the cotton chain in Brazil.

Fertilizers

The fertilizer market in Brazil continues to present major challenges and opportunities in 2024. The price of MAP (monoammonium phosphate), one of the main fertilizers used in Brazilian agriculture, reached the highest values of the year in June, reflecting a 12% increase over the previous month, with the tonne trading at USD 620.

Urea, an essential source of nitrogen, also saw its prices skyrocket after the Egyptian government imposed restrictions on production in May, resulting in an 18% increase, with the ton going from USD 305 to USD 360 on June 28.

In addition, restrictions on nitrogen exports by China have contributed to the pressure on global prices.